What are the key digital trends of 2019, and what are the key traits of successful “digital leaders”?

- Digital Trends

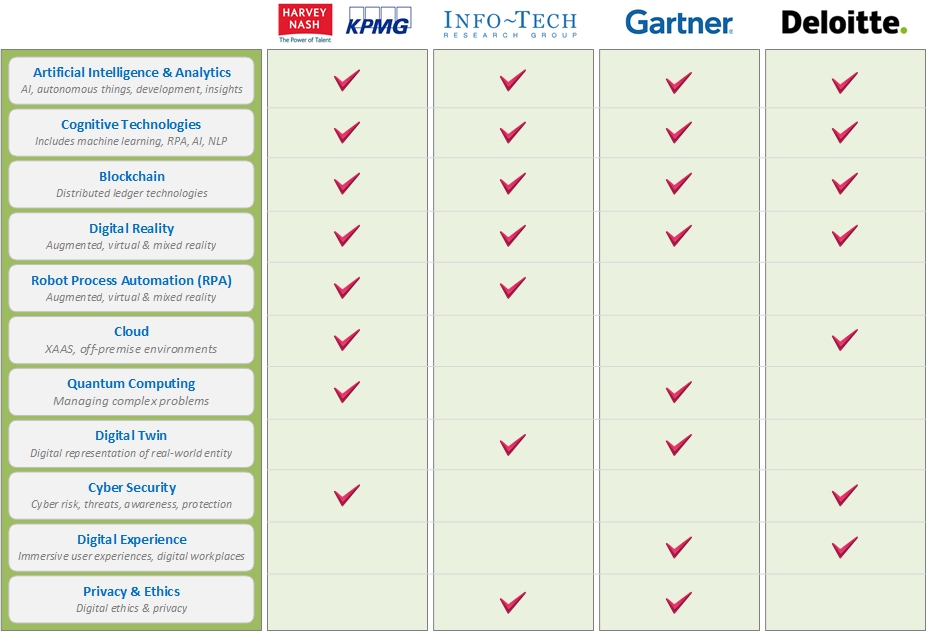

Research recently released by Harvey Nash/KPMG, Info-Tech, Gartner and Deloitte have highlighted a mostly shared view of of current and future technology focused trends. The research demonstrates that organisations are changing their product/service offerings or business models in a fundamental way, predominantly driven by digital disruption and the need to get closer to the consumer.

The combined research demonstrated an increased investment in cyber security, data analytics, AI/automation and transformation. Organisations not investing in AI and automation can expect, over time, for their cost base to be relatively higher than their AI-investing competitors.

The combined summarised view of digital trends is shown in the table below:

Digital transformation is becoming business as usual as enterprises look to stay ahead of the game. It has been recognized that digital transformation should and can be handled within existing budgets and without extra investment.

Digital transformations should be business led rather than IT led, to ensure business leaders are fully engaged with how their operations should be optimized for automation and digital change.

2. Digital Leadership

Leading organisations who demonstrate strong digital leadership experience improved time to market, superior customer experience and high operational efficiency. As a result, both revenue growth and profitability are higher too. Today, there is no longer business strategy and technology strategy. There is just strategy, and technology is driving it.

Digital leaders, as opposed to the Digital Management mainstream, have several traits that set them and their organisations apart from the rest. Digital Leaders distinguish themselves as being more outward-looking, using technology as a means of breaking into new markets, engaging with customers and gaining market share. They also tend to have different operating models that focus on the business owning and leading aspects of technology delivery in collaboration with IT.

Digital leaders:

- Implement new technologies end-to-end across functions and geographies and change the ways of working to maximise value from technology. They use cross-functional teams (IT and business staff) and ensure business leaders work collaboratively to deliver technology change

- Report business outcome-based metrics for technology projects, and scale up projects quickly if the project is successful or stop quickly if it isn’t.

- Integrate core business systems with newer digital solutions and bring a long-term ‘product’ rather than a short-term ‘project’ mindset to technology implementation. They employ automation in software development and maintenance, and use methodologies such as agile and DevOps to speed up project delivery

- Ensure that non-IT staff have the right technology skills, and use both internal and external resources to access the right skills

- Maximise value from the data they hold and maintain an enterprise-wide data management strategy

- Identify and manage the key security and privacy issues across technology development and operations, and build customer trust through the service delivered to customers and end user

In essence, digital leadership is about prioritizing value creation over efficiency generation, with a focus on speed and agility. The role is that of influence and partnering with the business rather than about control.

According to Harvey Nash / KPMG, the top 5 Board Priorities for digital leaders are:

- Developing innovative new products and services

- Delivering consistent and stable IT performance to the business

- Enhancing the customer experience

- Improving business processes

- Increasing operational efficiencies